In February, we issued 3,4M EUR loans and we exceeded 100M originations! Thanks to everyone who contributed!

I would like to share monthly results and platform news.

How was February?

Strong originations

In February, we maintained strong growth: we issued 1,95M Eur business (39% more than the average of the last 12 months) and 1,47M Eur consumer loans (3% below the average) and together we financed 3,42M Eur!

Record-breaking loan

For the first time, we financed a loan of 125.000 Eur with a real estate collateral in Vilnius!

We work hard to attract loans with the best risk-return ratio and offer investors exceptional opportunities to earn solid interest.

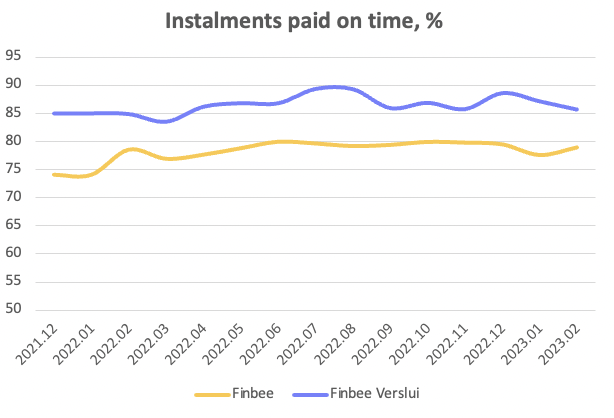

How many instalments were paid on time?

In February, 85,7% of companies and 78,9% of private individuals paid their instalments on time, excluding early repayments. The average of the last 12 months is 86,8% and 78,9%, respectively.

Finbee recovery results

How many instalments were recovered?

In February, we received proceeds from 498 consumer and 33 business loans with the help of judicial recovery. These are 28.3% and 19.0% of all late borrowers, respectively.

Consumer loan recoveries

Despite the fact that we have received contributions from more borrowers, the amount distributed to investors is slightly lower than the previous month. This happened primarily due to court fees being covered first, as a significant part of the recovered funds came from new borrowers.

In February, we distributed 71.776 Eur (1.99% of all non-performing loans) from consumer loans to investors.

Recovery from business loans

In February, we collected 18.464 Eur (2.26% of all non-performing loans).

This month we had two exceptional recovery cases where two different delinquent liabilities were fully covered by the mothers of the main shareholders who had co-guaranteed the loan.

How is recovery handled from a car collateral?

We are increasingly providing business loans with car collateral and we have our first insolvency case. The client’s loan will be refinanced, but how would the collection proceed if the borrower was unwilling to cooperate?

Recovery stages

In most cases, we provide a loan with a car collateral together with a personal guarantee.

In that case we run two parallel recovery processes:

1. Standard recovery process from the company and the guarantor through the court;

2. We apply to the notary for the issuance of an executive order for for directing recovery to the pledged property.

What happens when the executive order is issued?

After the notary has issued the executive order, we apply to the bailiffs for enforcement of collection. The bailiff seizes the pledged car and conducts auctions.

After the car is sold, the funds received are used to cover execution costs and payment of instalments.

What happens if the debt remains unpaid after selling the car?

If the funds collected after the sale of the pledged car are not enough for the entire loan balance, then we continue the collection from the company and the guarantor.

We start this process immediately after termination of the loan contract to ensure fast and efficient recovery.

Platform news

We have transferred information to Lithuanian Tax Office (VMI) about the received income and updated tax reports with 2022 information. When filling out the annual GPM declaration, it is sufficient to confirm the data provided for Lithuanian residents, for non-residents easy to download form is available.

Easier identification. If you do not complete the identification process and return to it later, the previously entered information is saved and this helps to activate the account faster.

Would you like to learn more?

I invite you to read:

100.000 EUR portfolio challenge by September. How is it going?

Interested in secondary market trading? Read a guide here.

Simas.