I present to you the investor report of Q3, in which we share the nearest plans for updating the platform and detailed statistics of the loan portfolio.

Key Events

Rapid Growth

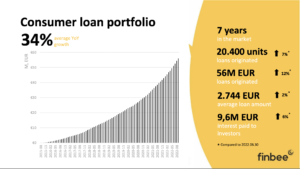

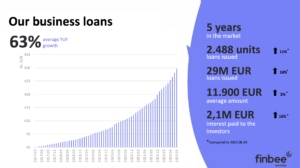

During 2022 Q3 we issued 4.9 million of consumer loans, which is 49% more than in the corresponding period last year, and 4.3 million euro loan business. The growth of business loans reaches 200% compared to the corresponding period last year.

We Invest Together

During Q3 of 2022 we invested 2.1 million Eur in consumer and business loans together with you, part of which we transferred to the “nordIX” fund.

Recovery Results

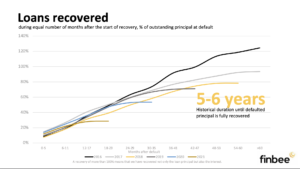

Recovery results are outstanding – over 120% of loans that became insolvent in 2016 have already been recovered. This means that we have collected both the outstanding part of the loan and the interest.

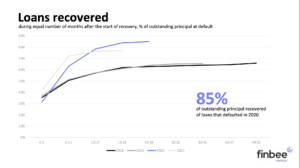

The results of business loans are not far behind – 85% of loans that became non-performing in 2020 have already been recovered.

Pro-active Debt Prevention

We achieved these results by actively working with borrowers. During the first half of the year, we sent more than 80.000 e-mails and 27.000 SMS messages to borrowers. We also made more than 5.000 calls to late customers to ensure the safety of the invested money.

TOP Investors

The largest legal investor on our platform manages a portfolio of 2.698.000 Eur, and a private person – 417.800 Eur. Where do you rank among all investors?

How much is it possible to earn on our platform?

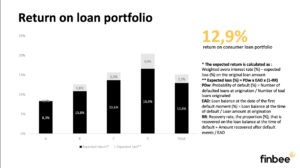

We strictly assess the credit risk of our customers and actively work with debt collection. This helps ensure probably the best returns in the entire European market. The entire portfolio of loans to private individuals generates a net return of 12.9% to our investors. The more risk investors tend to take, the more they have historically earned – D-rated loans generate the highest – 16.6% net return.

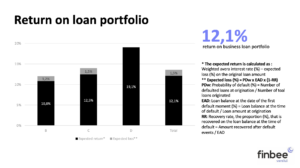

Business loans are not far behind private person loans – the net return of the entire portfolio is 12.1%. Historically, the best net return – 19.1% – is generated by D-rated loans.

I hope this information is useful for you. If you want to dive even deeper into the data of the report, I invite you to read it here.

I wish you a happy autumn and successful investments!

Simas.