Are you really investing your money effectively? Our analyst Dalia has prepared a wonderful calculator* where you can check the effectiveness of your lending criteria for consumer loans and look for even more profitable settings. Historically, D-rated loans generate the highest returns, despite the most frequent defaults. How to reduce the probability of delay?

How does the calculator work?

What can you find out in the calculator?

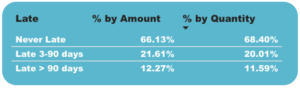

Using the calculator, you can find out what percentage of loans whose criteria you selected were never late, more than 3 days late, and more than 90 days late.

Example 1. According to the selected criteria, 11.59% of borrowers were late for more than 90 days.

How to chose the criteria?

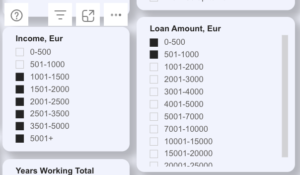

To check the criteria, it is enough to indicate your choices in the table.

To select more than one criteria, hold down the Ctrl / Command key while selecting.

Example 2. Selection of criteria if you want to check borrowers earning at least 1.000 Eur and borrowing up to 1.000 Eur.

How to find the best criteria?

We’ve covered the data that has the biggest impact on solvency in this post, and you can find it below.

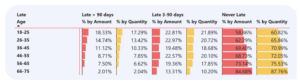

If you want to check the latest data, it is enough to select the detailed statistics of individual criteria and you will see the result of each criterion.

Example 3. 17.29% 18-25 years old borrowers were overdue by more than 90 days.

Is it possible to beat our credit scoring?

So far, I have found a few combinations that tend to be less late and have higher interest rates than higher-rated loans. For example, D-rated women who work at their current workplace for more than a year and borrow up to 24 months are less likely to be 90 days or more late than the average C-rated borrower.

TOP 12 Lending Criteria

We delved into the historical statistics and look for the settings that have the biggest impact on loan repayment.

12th place. Refinancing

Despite the fact that refinancing loans are designed to lower the payment and save money, they have an 18% higher probability (14.6% vs. 12.32% of the portfolio average) to be more than 90 days late.

11th place. Gender

This is a general trend – men are 22% more likely to be over 90 days late than the overall portfolio average. There is no unified explanation for this phenomenon, but there is an assumption that women are more likely to ask their relatives for help to cover late loans.

10th place. Real Estate Ownership

Borrowers who do not own their real estate are 25% more likely to be more than 90 days in arrears. The more assets the borrower has, the greater the chances that the loan will be repaid on time.

9th place. 3 and more children

Large families face significant costs associated with raising children and are 30% more likely to be late for more than 90 days.

8 vieta. Marital Status

Single borrowers are 32% more likely to be over 90 days late. This can be associated with the help of the partner in overcoming financial difficulties.

7th place. Income Size

Borrowers with an income of up to 500 Eur per month are 32% more likely to be late for more than 90 days. This is due to the smaller amount of available funds left after covering the living expenses. Oddly enough, customers earning over 3.500 EUR per month have a 36% higher probability of becoming insolvent. However, the sample of these customers is very small and the probability calculation can be significantly influenced by chance.

6th place. Age

Customers who are 46 years of age or older have a 35% lower probability of becoming insolvent. This can be explained by the accumulated experience in assessing the financial status of oneself and one’s family, as well as a longer working experience.

5th place. Loan Amount

Small loans are financed instantly. And for a good reason – loans up to 500 Eur have a 36% lower probability of late more than 90 days compared to the entire portfolio. The smaller the loan, the easier it is to service it.

4th place. Returning Customer

Our returning customers are 37% less likely to be late for more than 90 days. The better we know the borrower – the more accurately we estimate the probability of repaying the loan on time.

3rd place. Education

Borrowers with a higher education degree are 42% less likely to be more than 90 days late. Quality education opens more doors in the job market and it helps borrowers to manage their personal finance better.

2nd. Loan Term

Short term loans are another popular choice for our investors. Consumer loans up to 12 months have a 52% lower probability of being overdue by more than 90 days. On the other hand, the longer the term of the loans, the longer the period you fix the interest rates that tend to decrease in the long-term.

1 vieta. Work Experience

Borrowers with more than 10 years at their current workplace are 61% less likely to be late for more than 90 days. The longer the work experience – the more financial stability.

Can it get any better?

Do combinations of the best criteria perform even better? You will find out in October. :)

Simas.

*These fields of loans issued before September 2019 may be inaccurate due to incomplete data migration from the old Finbee platform: Marital status, Type of housing, Education, City, Number of children, Work experience in years, Work status, Current workplace (years), and Work experience (years).