We would like to share the results of the March collection and the answers to the questions asked by investors about the collection.

Frequently asked questions

10% of my loan portfolio consists of bad loans. What is the probability that that percentage will approach zero? When is this indicator good/bad?

The probability that the average loan agreement will be terminated is about 11%. Historically, expected loan loss is 1.4%, so it is likely that the bad loan balance of a broadly diversified portfolio will approach this number eventually.

You should also remember to assess how much of the invested funds were withdrawn to the bank account, because returned loans that were not invested further and were paid off increase the proportion of bad loans in the active portfolio.

We recommend evaluating the amount of bad loans based on the amount of loans granted.

What percentage of all loans issued in Finbee’s history are currently in recovery?

Currently, 4.3% of issued consumer loans and 3.1% of business loans are in recovery.

Business loans almost always come with a personal guarantee – are there many cases where the personal guarantee is not enough to collect the full amount?

The guarantee is signed for the entire amount of the loan and all receivable interest during the agreed loan period, so the amount of the guarantee is in all cases sufficient to collect the entire amount.

“We recovered funds from 43.2% of consumer and 16% of business loans with terminated contracts.” From which loans are these figures calculated?

This indicator shows what part of the loans with terminated contracts we received payments from last month. For example, if out of 100 business loans with terminated contracts, we receive payments from 16 loans, this means that we have collected funds from 16% of business loans with terminated contracts.

Payment received from the bailiff. Funds are distributed to investors after covering litigation costs (37.58% covered). The question is, does this somehow affect the amount I get back?

The costs of litigation are covered on a first basis. We financing litigation costs at our own expense. Litigation costs are borne by the borrower and the amount owed to investors is not affected by the costs of litigation.

Why are some loans delayed and collected from them, while others are delayed and not collected? What is the decision based on?

Non-performing loans are an integral part of loan investing. Collection flow depends on whether the borrower has income that we can collect. If the borrower does not receive income, there is nothing to enforce recovery.

Historically, consumer loans are recovered within five years. Each borrower’s case is unique, some loans are recovered within months, some will never be recovered.

How does recovery from insolvent farmers work? Although this is a business loan, the “Guarantee” field is left blank. Do they still personally guarantee the loans?

We finance farmers as natural persons. As a result, an additional guarantee is not required, as the farmer is personally responsible for repaying the loan.

Are there no plans to shorten the time it takes to terminate a contract and go to court?

We terminate the consumer loan agreement after at least 120 days of delay, business – after 56 days. The termination term of consumer loans is regulated by the Law on Consumer Credit; we do not intend to shorten the term of business loans, it meets market standards.

Is it true that all debtor X’s cases end up with one bailiff? Previously, different cases could end up with different bailiffs. How has this change affected Finbee?

The information is correct. However, it is true that the cases of the guarantor and the company may be with different bailiffs. Recovery results are not affected by this change.

Is it better to collect from individuals or companies?

The collection results in the first three years after the termination of the contract are similar, in the long term, collection is slightly more effective from consumer loans. This can be attributed to the smaller size of consumer loans (the average business loan is more than 5 times larger).

What is considered a loan in recovery? Why is the loan considered recoverable if the payment is delayed by x days?

We consider those loans whose contract has been terminated as loans in recovery. We terminate the consumer loan agreement after at least 120 days delay, business – after 56 days.

Our recovery results

How many instalments were recovered?

In March, we received collection from 824 individuals (7% more than in February) and 57 companies (42% more than in February). We collected funds from 45.9% of consumer and 21.9% of business loans with terminated contracts.

Recovery from consumer loans

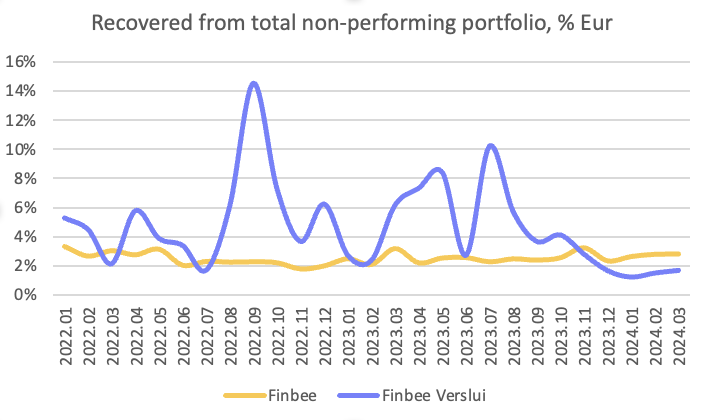

In March, we distributed 140.533 Eur from consumer loans to investors (2.81% of all non-performing loans).

The largest recovered amount is 8.208 Eur.

Recovery from business loans

In March, we recovered 33.987 Eur from companies (1.7% of all non-performing loans).

The largest amount recovered from one company is 5.911 Eur.

Simas.