We periodically receive questions from investors about how much and in what loans we invest ourselves, as a platform. We would like to share our investment strategy.

Finbee investment strategy

How big is our portfolio?

We believe in our business and actively invest together with you.

Currently, the active loan portfolio of our companies exceeds 8.300.000 Eur. During the last month, the portfolio generated 122.318 Eur in interest and contributes to the profitable operation of our platform.

Fast loan origination

Some loans are large and without our help the financing would take a long time or not be completed in full.

We invest together with you to ensure fast disbursement of loans to borrowers.

Contract fee

A significant part of our company’s income consists of the contract fee. In order to be able to apply this fee at the time of disbursement of a consumer loan, we must co-finance at least 12% of the loan amount according to the current Consumer Credit Law requirements.

How was May?

During the month of May, we issued more than 3.8M Eur! Thanks to everyone who contributed!

I would like to share monthly results and platform news.

Solid originations

In May, we issued 1.89M Eur business (8% more than the average of the last 12 months) and 1.97M Eur consumer loans (17% above the average) totalling at 3.86M Eur!

New feature

From now on, you can set a minimum cash balance in the Dashboard window and the selected amount will not be loaned out by auto-lending portfolios. For example, if a limit of EUR 200 is set, free funds in the account will accumulate up to 200 Eur, once this amount is exceeded – the excess amount over 200 Eur will be lent.

We would like to thank our investor Darius for the suggestion!

How many instalments were paid on time?

In May, 79.6% of companies and 82.6% of individuals with active contracts paid their instalments on time, excluding early repayments.

Furthermore, we want to assure you that we are closely monitoring the current situation where fewer loan recipients have made timely payments this month and will take necessary measures if required. We continuously update loan evaluation criteria to ensure stability and reliability.

Platform news

New feature: minimum cash balance that is not lent.

New feature: the loan schedule displays when the last instalment payment was received, if the payment was late – it displays how many days the delay lasted.

Bug fixed: in rare cases, the spouse’s income was misrepresented.

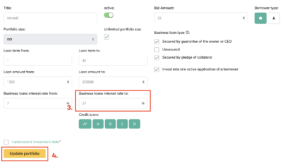

D-rated business loans’ interest – up to 24%

From now on we provide D-rated business loans with interest rates up to 24%.

Don’t miss out on the highest yielding loans and update the maximum interest rates on business loans in your auto loan portfolio settings.

How to update AutoLend settings?

1. Press AutoLend in the self-service.

2. Press on the pencil next to the autolend portfolio.

3. Update maximum interest for the business loans.

4. Update portfolio settings.

Our recovery results

How many instalments recovered?

In May, we received proceeds from 662 consumer (23% more than in April) and 51 business loans (4% more than in April). We collected funds from 35,0% of consumer and 24,8% of business loans with terminated contracts.

Recoveries from consumer loans

We had a strong recovery performance from consumer loans.

In May, we distributed 92.657 Eur from borrowers to investors (2.40% of all non-performing loans).

The largest recovered amount is 4.347 Eur.

Recoveries from business loans

We have had the best month so far this year for business loans recovery – we collected 70.199 Eur (8.57% of all non-performing loans).

The largest amount recovered – 9.803 Eur.

Simas.