We often receive questions about how to earn in the secondary market and we are starting a series of secondary market strategy articles. We will release new articles every month.

How to earn a whole month’s interest in a few days?

The borrower pays the interest on the loan to the investor for the whole month.

If you buy a loan whose payment is due tomorrow and the borrower pays it on time, you will receive interest for the whole month, even though you only lent the money for a day.

When looking for a loan, it is worth paying attention to two things:

1. When is the loan instalment due? – the shorter the period, the faster you will receive interest;

2. Does the borrower tend to be late? – the more often the borrower is late, the greater the risk that it will take time to receive the payment.

However, the strategy has two cons:

1. The risk that the loan will be late and it will not be possible to earn interest in a very short period of time;

2. Time-consuming activity – in order to review the loan schedules, you will need to spend some time.

Investment case

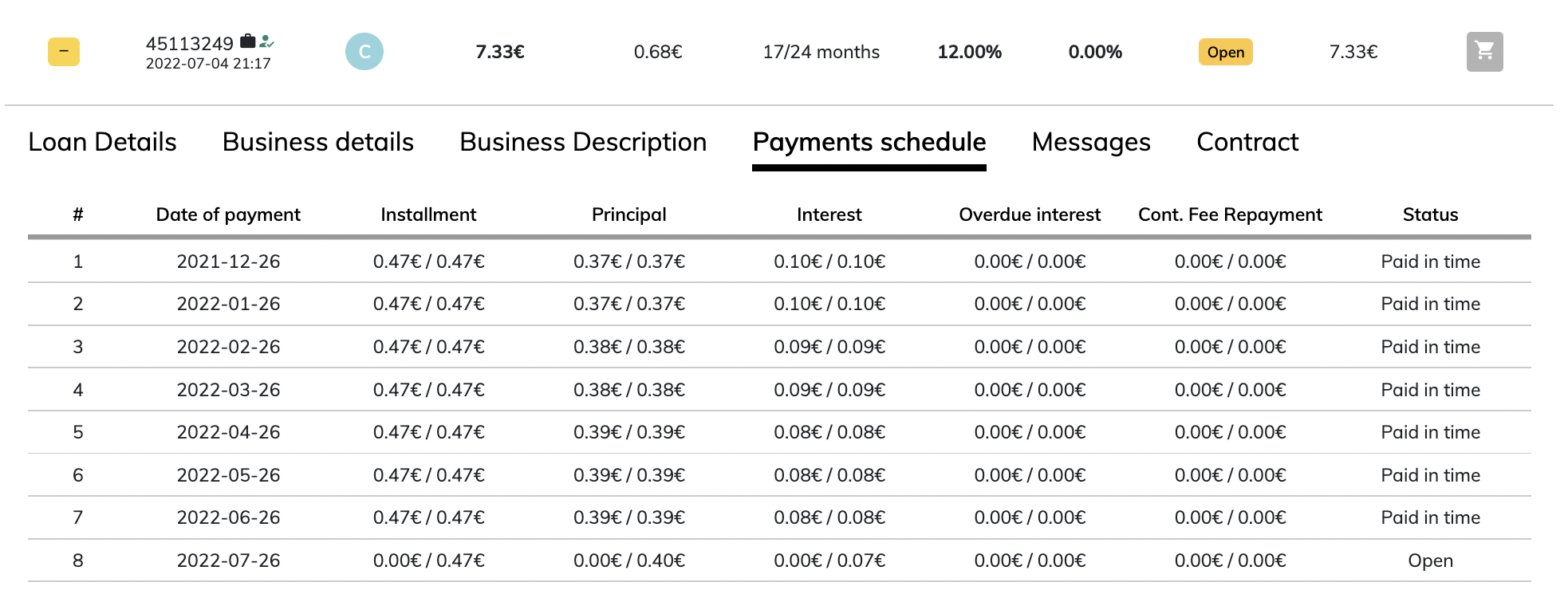

- We are looking for a loan with a payment due in a few days. The more instalments the borrower has paid, the better, because we know his payment history.

- We check whether the borrower has been late recently by clicking on “Messages”. If the borrower has not been late so far, it is more likely that he will not be late when making the next payment.

- After the borrower has paid the instalment – the loan can be immediately put up for sale at par price. After the loan is sold, the profit in the amount of the monthly interest is kept. Alternatively, the loan can be kept further.

This strategy is useful when buying and selling loans. Prior to selling a loan that has an instalment due in a few days, you may want to wait and sell it after receiving the interest.

I wish you good investments!

Simas.