In August trade in the secondary market remained stable – although almost a third more transactions were completed than in July – 3.970, but the total turnover of the secondary market for the month was 2% lower – 73.093 Eur.

This month we present the final, third part of our series of secondary market strategy articles. From now on, we will publish secondary market statistics on a quarterly basis, along with a report to investors.

Secondary market strategy: (non)-performers

Are all customers with terminated contracts insolvent?

Some borrowers face financial difficulties over time and become insolvent. In this case, we start the recovery process and it takes an average of five years.

How to find a (non)-performer?

Using this strategy, we aim to recover the invested money as quickly as possible. We are looking for debtors whose court proceedings have already ended and whose bailiffs’ deductions are constantly received. When the bailiff successfully collects interest, you will also receive interest for past periods, thus increasing your return.

Cons of strategy

1. The risk that the borrower will become insolvent again and the invested money will remain frozen for a long time;

2. It is a time-consuming activity – you will need to spend time to view the loan schedules.

How to manage risk?

When looking for a loan, it is worth paying attention to three things:

1. How much do you want to earn? – if the loan will be collected within five years, what discount is acceptable to you?

2. How long does bailiff’s deduction flow last? – the longer the collection history – the greater the probability that the regularity of the payment collection will remain unchanged (e.g. the borrower has found a job).

3. A long loan term is more beneficial – the court awards lost income for the entire loan term. If the recovery of the loan takes longer than expected, you would claim more interest.

Investment case study

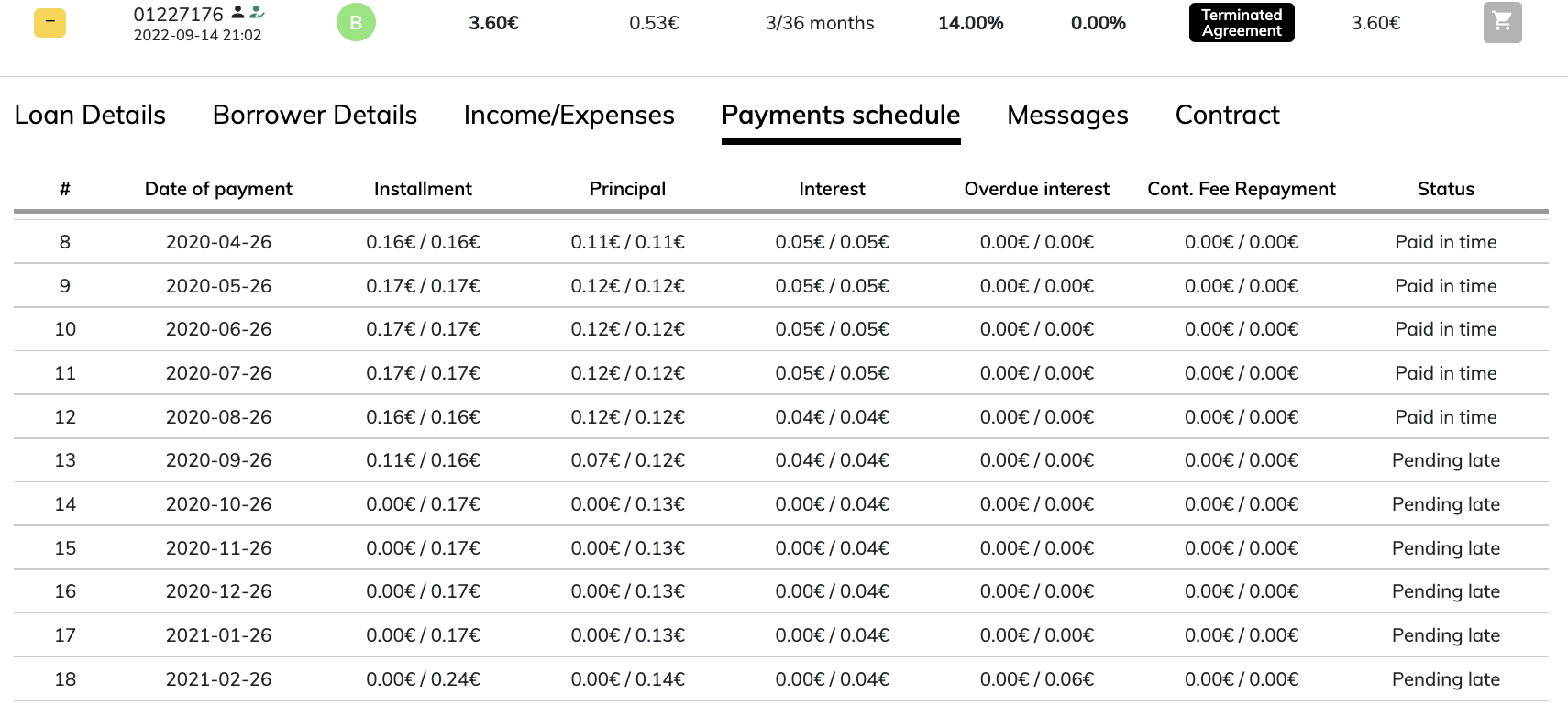

1. We are looking for a loan whose contract would be terminated, delay up to 120 days (for business loans – up to 56 days).

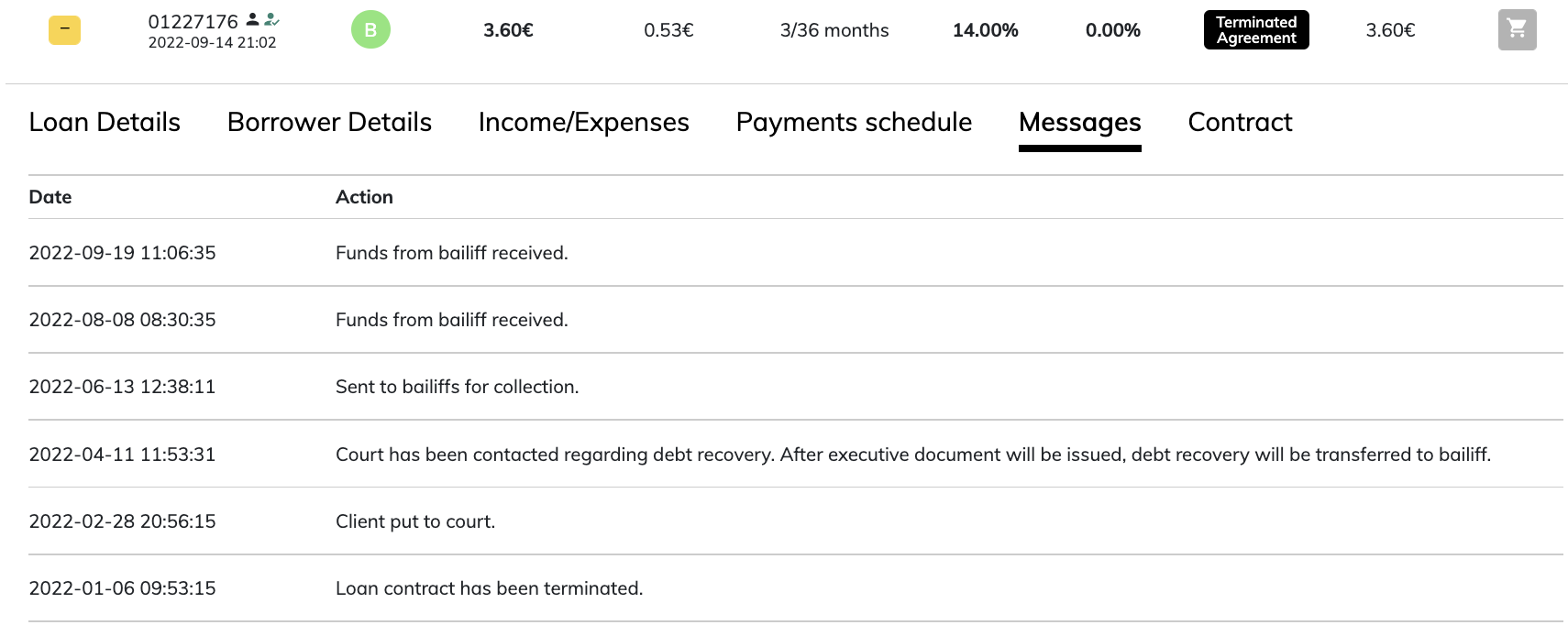

2. We check the situation with the borrower by clicking on “Messages”. If the instalments are collected constantly, the investment may be interesting for us.

3. About 15% of the total debt was recovered from this borrower in two months, so even if you buy this loan at par, you can expect to recover the entire investment relatively quickly with unpaid interest from September 2020.

4. When you buy a loan at a discount, you can immediately put it up for sale at a lower discount than what you bought it for. Once there is a buyer, you will keep the difference as profit.

The size of the amounts collected and the date of payment of the instalment are not currently displayed in the loan schedule on the platform. The status of the debtor remains to be decided according to the reports of our recovery team.

Soon we will update the display of late payments and the loan schedule will display the date when the payment was last paid, so it will be easier to follow this strategy. We are also planning to add an additional filter based on the date of the last payment in the secondary market.

Simas.