In December, we raised 3.5M Eur together! Thanks to everyone who contributed!

I would like to share monthly results and platform news.

How was December?

For the first time, we issued 2M Eur business loans!

In December we issued 1.37M Eur consumer (6% less than the average of the last 12 months) and – 2.13M Eur business loans (69% above the average) and together we raised 3.5M Eur!

Business loans with a deferral of up to 6 months

We aim to offer our customers the most flexible financing products possible, and from now on we offer financing with a deferral of up to 6 months to customers with a lower credit risk.

If the loan is deferred for three months, the interest for the first three months will be paid together with the first instalment after the deferred payment.

If the company repays the loan earlier, the interest is calculated until the loan repayment date.

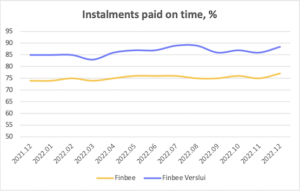

How many instalments were paid in time?

In December 88% of companies and 77% of private individuals paid their contributions on time, excluding early repayments. The average of the last 12 months is 86.5% and 75.3%, respectively.

Finbee recovery results

How many instalments have we recovered?

In December, we received proceeds from 420 consumer loans and 34 companies. These are 24.6% and 22.5% of all terminated loans, respectively.

Consumer loan recoveries

In December, we distributed 68.208 Eur proceeds from non-performing consumer loans (1.93% of all NPLs).

The largest recovered amount – 8.421 Eur! This loan was collected in less than a month after the executive order was handed over to the bailiffs.

INTERESTING. One of our borrowers was late with the loan payments, but the client was lucky enough to win the lottery and the winnings were used to fully cover the existing loans.

Business loan recoveries

In December, we collected 41.408 Eur (6.56% of all non-performing loans).

The largest recovered amount – 10.606 Eur!

Platform updates

Deposit payment initiation. We have launched easier way to replenish your investment account via major Lithuanian banks and Revolut.

More convenient display of recovery results. From now on, you can monitor how much funds have been collected in your account statement by filtering payments according to the “Loan repayment after agreement termination” attribute.

Consumer loan borrowers can sign the loan agreement with e-signature, this ensures faster disbursement of loan funds.

We started providing consumer loans to retirees, for whom we apply a stricter 35% maximum debt to income ratio.

We increasingly use bank statement information when assessing the credit risk of consumer borrowers.

Simas.