In January, we together issued almost 3.5M Euro! Thanks to everyone who contributed!

I would like to share monthly results and platform news.

How was January?

Fast growth

After a record-breaking December, we maintain an impressive growth rate. In January, we issued 1.81M Eur business loans (39% more than the average of the last 12 months) and 1.67M Eur consumer loans (12% above the average) and together we issued 3.48M Euro!

A swarm of new bees

In the first month of the year, as many as 333 new investors joined our hive!

Know more bees? Invite them to join and let’s earn solid returns together!

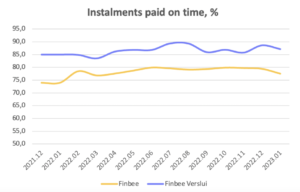

How many instalments were paid on time?

In January, 87% of companies and 77% of private individuals paid their instalments on time, excluding early repayments. The average of the last 12 months is 86.8% and 78.9%, respectively.

Our recovery success

How many instalments were recovered?

In January, we received the proceeds of court recovery from 495 individuals and 28 companies. These are 28.5% and 17.3% of all late borrowers, respectively.

Growing recovery of consumer loans

In 2022, we sent many debtors to bailiffs and we see a growing flow of money from recovery. In the first month of this year, we distributed 85.924 Eur (2.40% of all non-performing loans) from borrowers to investors.

The largest recovered amount – 10.590 Eur! This loan was collected within a month and a half after the executive order has been sent to the bailiffs.

Business loan recovery

In January, we collected 21.411 Eur (2.83% of all non-performing loans) from late business loans.

The largest recovered amount – 10.334 Eur!

Platform updates

Payments initiation. From now on, topping up your investment account is even easier – you can make the payment using self-service.

Easier identification. New investors of the platform can confirm their identity faster using a mobile signature or smart ID.

Fixed bug: Klix and business loans with deferred annuity schedule that are not late are displayed with a status “Open”.

Simas.