Peer-2-peer (P2P) lending platform is the place where people lend money to other people. P2P lending helped to create more innovative and transparent ways to borrow and lend money. In order to diversify investment risk, investors usually invest small amounts into each loan. Loan amount is usually financed from ten up to more than hundred investors. This helps to diversify your investment risk and reduce potential losses in case of default.

The first P2P company was founded in 2005 in United Kingdom and now P2P lending is popular across the world. Most of P2P companies are working in United States of America and United Kingdom.

Finbee is an online lending platform created in 2015. Our goal is to become the leading peer-to-peer lending company in Lithuania.

All financial transactions between investors and borrowers are performed through our payment partner JSC “Elektroninių pinigų bitė”. In order to protect our clients, we keep clients’ funds in segregated bank account.

JSC “Finansų bitė” (Finbee) is listed in the Bank of Lithuania’s consumer lenders and peer-to-peer lending operator list. JSC “Elektroninių pinigų bitė” is listed in the Bank of Lithuania’s electronic money institutions list. JSC “Finansų bitė verslui” (Finbee Business) is listed in the Bank of Lithuania’s crowdfunding platform operator list.

Finbee is a peer-to-peer (P2P) lending and crowdfunding platform that connects those who want to borrow with those who are looking for diverse investment opportunities.

Phone: +370 5 2199529, press 3 if you have questions regarding investing at Finbee.

Email: [email protected]

Working hours: From Monday to Friday from 8 a.m. to 5 p.m.

We collect Finbee’s customer ratings through the NPS (Net Promoters Score) survey. Here is an average of customer rating scores. We collect and update customer ratings once every six months.

Investing at Finbee

General questions

You can invest at Finbee if:

- You have a bank account in one of EEA countries (You can find list of EEA countries here: https://www.efta.int/eea/eea-agreement/eea-basic-features#2);

- You are at least 18 years old;

- You have a valid personal document (ID card or passport; Driver‘s license is not a suitable document).

If you would like to invest at Finbee and you have met all criteria for investors, you should register at Finbee as investor. Once you have created your account at Finbee, first you have fill client questionnaire (KYC), which is prepared according to Anti-money laundering law requirements in Lithuania. When questionnaire is confirmed by our AML specialist, you need to add funds on your account to start investing.

All data provided is confidential and will not be publicly available to third parties.

The minimum amount to invest is 5 EUR. 5 EUR is the smallest investment in a single loan. We advise investing small amounts in each loan. This means that you do not have to finance whole sum of a loan that borrowers apply for. Usually up to a few hundred investors finance each loan. Maximum amount that you can invest into consumer loan is 500 EUR. This means that you can lend up to 500 EUR for one borrower in 12 months period (according to Lithuania’s consumer credit law requirements). This limitation doesn’t apply for business loans. Good diversification decreases the risk of losses in case loan defaults. We advise to start lending small amounts, evaluating and understanding the principles of Finbee operation as well as investment risk and only then start lending larger amounts.

If you want to transfer money to your Finbee account, please find details for transfer below:

Receiver: UAB „Elektroninių pinigų bitė“

Receiver address: Vilniaus st. 4-10, LT-01102, Vilnius, Lithuania

Bank name: AS „Citadele banka“ Lietuvos filialas

Bank address: Upės g. 21-1, LT-08128 Vilnius, Lithuania

SWIFT code: INDULT2X

Bank account number: LT967290099016897761

Unique reference: Your unique account ID

You must transfer funds from your personal bank account. Withdrawals will only be made to your personal bank accounts from which at least a single deposit has been received in the past.

There are no fees applied for deposits or withdrawals at Finbee.

Please note that money transfers might take up to one working day.

The first deposit should be made directly from your personal bank account in order to add bank account for your withdrawals. Later you can use TransferWise, PayPal or other companies that offers money transferring services for depositing money into your Finbee account.

Transferring funds to Finbee or paying withdrawal to your bank account may take up to one working day.

No. Once you have confirmed your investment, you cannot cancel it. When you are making a bid, you agree with conditions that the bid is irrevocable. In case you are not satisfied with your bid, you can always use the secondary market to sell your loans to other investors.

Log in to your Finbee account, press “Account“, then you should pick section “Withdrawal“ and enter the amount that you wish to withdraw. Requested amount will be transferred to your bank account within one working day. If you see notification that you don‘t have a registered bank account, please contact us by email: [email protected].

Please make a deposit from your new personal bank account and write “Your unique account ID. Change of bank account” in unique reference. Your registered bank account will be changed in one working day after we have received your deposit.

According to Lithuanian Consumer Credit Law, consumer credit interest is charged only on the amount the borrower has received into his bank account. Therefore, the interest cannot be calculated on contract fee paid by the borrower at the moment of loan disbursal.

Contract fee depends on credit score and term of the loan. When investing in loans on primary market you will see two sections: “Bid amount” and “Loan amount”. “Bid amount” is amount that you are lending to the borrower. “Loan amount” is amount from which receivable interest is calculated. The borrower will repay “Bid amount” during the term of loan.

This applies to consumer loans only. When investing in business loan you will receive interest on total amount invested.

All consumer loans have annuity repayment method. This means that the borrower pays equal monthly installments till maturity of loan. These monthly installments consist of principal part, interest, repayment of contract fee and monthly fees. Investors receive principal part, repayments of contract fee and interest on monthly basis. Interest is calculated from principal amount outstanding which is decreasing each month after each repayment. For example if you lend 100 EUR, in the first month you will receive interest from whole loan amount (loan amount is equal invested amount minus contract fee). In the second month you will receive interest from smaller loan amount, because borrower paid monthly payment and repaid part of the loan in the first month. This means that you loan part will decrease from 100 EUR to 0 EUR during loan period. If you want to calculate your receivable interest approximately, please divide loan amount by 2 and then calculate receivable interest for all loan term.

Interest rate depends on borrower’s credit score and term of the loan. You will be able to see preliminary return before investing with the assumption that the borrower will pay his monthly payments on time for all loan term:

a) Loan amount is amount that generated interest for you.

b) Preliminary return is receivable interest for all loan term with the assumption that the borrower will pay his monthly payments on time for all loan term

c) XIRR is index usually used in Peer-to-peer lending platforms for investment return evaluation. XIRR shows annual return according to invested amount and planned future payments. XIRR is calculated with the assumption that borrower will pay installments on time.

These numbers mentioned above is only preliminary. Actual numbers might differ due to:

a) Algorithm how Finbee payment schedule is generated.

b) Rounding errors.

c) Actual payments of the borrower.

d) Other factors.

P2P and crowdfunding platforms creates a possibility for investors to diversify their investment by investing small amounts. This possibility is essential for P2P and crowdfunding platforms because it allows for small and big investors use this kind of platforms for their investment. For example, if the minimal amount to invest would be significantly increased, small investors would not use our platform. The minimum investment amount is 5 EUR at Finbee. The smallest unit of measurement is 1 cent and when investor invests small amount generating a detailed loan schedule can cause some rounding errors. We would like to assure you that we are trying to minimize these rounding errors as much as we can.

Firstly, we calculate total amount of interest during loan period. This helps to ensure that investor earns correct interest amount and actual return will be the as close a possible to the preliminary return calculated before investing is made by an investor.

Then system checks if sum of each month interest amount is not exceeding total receivable interest that belongs to investor. If due to rounding errors total amount of receivable interest exceeds amount that investor should receive for this loan part, we adjust several last monthly interest payments by decreasing them. If due to rounding errors, investor would get less interest than he should, interest amounts of several last monthly installments will be increased. This helps to ensure that the investor will get correct amount of interest during the loan term.

The same principle is used when system generates payment schedule for principal loan part and contract fee repayments. Principal part and contract fee repayments must be equal to invested amount, so these two columns are directly related. You can see that contract fee repayment part can be bigger or smaller for a few last monthly installments and this is due to rounding errors which occur during the term of the loan. You might notice that due to this correction actual sum of contract fee repayments might differ to the one that was shown to you before investing into a loan.

Principal part and contract fee repayments are equal to invested amount. The main difference between these two numbers is that according to Consumer Credit law of Lithuania it is forbidden to calculate interest on contract fee. Therefore investors cannot receive interest from that part of the loan that used to cover contract fee. Receivable interest does not depend on how principle part of the loan and contract fee repayment are distributed during the loan term.

The borrower pays monthly installments according to his/her payment schedule which later is divided to investors according to their payment schedules. One loan usually has about 130 loan slices on average. Borrower‘s monthly installment should be distributed to all loan slices and due to number rounding it is difficult to do so. Finbee as P2P platform is an intermediary between borrowers and investors and must divide exact amount of money that has been received from the borrower. The sum of all investors receivable installments must not exceed the borrower‘s installment. All these rounding errors are corrected at several last loan slices. In order to make things clearer please find an example below:

Borrower pays monthly payment – 130 EUR. This monthly payment must be divided for 150 investors. Each investor should get 0.86666 EUR (if the amount is rounded – 0.87 EUR). In this case we must pay to investors 130.50 Eur, but the borrower paid only 130.00 EUR. So, system solves these discrepancies when loan schedules are generated.

Differences are evened out at the last few loan slices, so the last few loan slices usually have bigger rounding errors that other loan slices.

There is one limitation for consumer loans. One investor can lend to one borrower up to 500 EUR in 12 months period. This limitation means that you cannot invest more than 500 EUR in one consumer loan. This limitation does not apply for business loans.

If you want to delete your Finbee account, please contact us by email [email protected] and inform us that you would like to do so. The letter must be sent from the same email address that was used to register at Finbee. Also we would like to draw your attention that due to Anti Money Laundering, Consumer credit law and GDPR requirements, your account will only be disabled, but your data will be saved for required period if the law requires so. All your personal data will be deleted after this period ends.

Yes, companies can invest in consumer and business loans via Finbee. If you wish to start investing as a company please contact us by phone +370 (5) 219 9529 or by email [email protected]

Electronic money institution “Elektroninių pinigų bitė” has a segregated bank account where investors’ funds are held. All investors deposits held in this bank account are investors’ personal property. This bank account is completely segregated from JSC “Finansų bitė”, JSC “Elektroninių pinigų bitė” and JSC “Finansų bitė verslui” assets. All loan agreements are made directly between borrower and investor, so in case Finbee goes bankrupt, all loan agreements remain valid.

Finbee has prepared and coordinated the Plan of Business continuity with The Bank of Lithuania. According to the Plan, new administrator will take over administration of all active loan agreements in case Finbee goes bankrupt. The main purpose of the Plan is to protect investors’ rights in case of bankruptcy.

Peer-to-peer lending is vulnerable to the investment risks as well as other financial instruments. Before investing into unsecured loans, you must evaluate your personal and family financial standing as well as your business financial situation and investment risk.

Your investments through Finbee platform are not insured or secured in any other way (except for some business loans that are secured by collateral). We do not guarantee that all borrower will meet their financial obligations.

Finbee does not provide any king of buy-back guaranties or any other guaranties.

It is lender’s responsibility to choose a loan and to evaluate the risk. Finbee is not responsible for insolvent clients or any losses of the lender.

If you decide to terminate the Portal agreement of Finbee platform, you will not be able to continue investing from the moment of termination. If, at the time of termination, you still have active loan agreements and you will be receiving payments in the future, you can choose to sell your existing loans in the secondary market before termination or keep those loans in your portfolio. If you decide not to sell your existing loans, but terminate the Portal agreement, you will still be able to withdraw funds available or sell your active loan in the secondary market at any time.

Autolend

AutoLend portfolio uses your available funds in your Finbee account. You don’t have to add or transfer funds to your AutoLend portfolio. Although you can limit your AutoLend portfolio size in portfolio settings.

Please make sure that your AutoLend portfolio has not reached its portfolio size limit. If the limit has been reached, please increase your AutoLend portfolio size limit or choose unlimited portfolio size.

Portfolio size limits your investment which is made through your AutoLend portfolio. You can choose unlimited portfolio size or select amount that you wish to lend using the specific portfolio. AutoLend portfolio will use available funds to make bids until it reaches selected portfolio size. When portfolio will reach its size limit, AutoLend stops making bids until amount outstanding of loan portfolio decreases below size limit. For example, if you limit portfolio size at 1000 EUR, AutoLend portfolio makes bids until it lends 1000 EUR. Then AutoLend portfolio stops making any new bids. When some borrowers will pay several loan installments and your loan portfolio size decreases, your AutoLend portfolio will make bids again to sustain selected portfolio size.

Please check your AutoLend portfolio criteria. Make sure that all criteria have been set correctly. Please make sure that your portfolio size limit is bigger than 0 EUR. If everything seems right and your AutoLend portfolio is still not placing any bids, please contact us by email: [email protected].

Debt collection

Debt collection process starts 4 days after the borrower missed monthly payment. Notification about late payment is sent on this day. Later we are trying to contact borrower by phone calls, SMS messages, email and old fashioned letters sent by the post.

Loan contract can be terminated when borrower is more than 90 days late. When a borrower is late for more than 90 days, notification due to contract termination is sent. After this notification the borrower has 14 days to pay his debt (missed monthly installments). If the borrower fails to do so, the loan contract is considered terminated. Then we are preparing documents for the court and a client is put to court. After court decision is made, the borrower is sent to bailiff for debt collection.

You can find information about debt collection process next to each loan: section “Portfolio” -> “Active loans” -> click on the selected loan -> Section “Messages”. If you have any other additional questions about debt collection process or specific loan, please contact us by email [email protected] and don’t forget to add loan ID.

Investors does not have to pay any fees for debt collection at Finbee. All collected money from the borrower is transferred to lenders (except for direct costs of debt recovery, such as court, bailiff and legal fees).

A loan is considered a bad debt when the borrower misses his/her payments for more than 91 days. Bad debt principal does not necessarily mean that this is your loss. Finbee is responsible for debt collection process and we are still working on collection of bad debts. You can find information about debt collection process next to each loan: section “Portfolio” -> “Active loans” -> click on the selected loan -> Section “Messages”. If you have any other additional questions about debt collection process or specific loan, please contact us by email [email protected] and don’t forget to add loan ID.

In loan portfolio table 91+ days late amount shows total amount outstanding of loans that are late for more than 91 days. This number shows whole outstanding loan amount. This table helps to evaluate your loan portfolio quality. “Bad deb principal” shows principal of all late repayments of loans that are overdue for more than 91 days. In loan portfolio table 91+ days late amount shows total amount outstanding of loans and “Bad deb principal” shows total principal amount of all late repayments. Interest is not counted in “Bad debt principal”, because it is not considered as your loss.

We would like to note that „Bad debt principal” does not necessarily shows your losses. “Bad deb principal” might be recovered from the borrowers and Finbee is working on debt collection.

Net profit might decrease due to loans that are overdue for more than 91 days. Net profit might decrease due to new loans that have defaulted or when a loan that was previously defaulted has new late monthly installments. The more borrower misses his/her monthly installments, the more it affects your net profit. Decreasing net profit with the amount of bad debt principal helps investors to evaluate quality of their loan portfolio and estimate their profit after potential losses. If the borrowers pay all missed monthly installments, net profit will become equal to received interest (if you didn’t make any transactions on secondary market). Also, we would like to ensure you this is only theoretical calculations and Finbee are not deducting any fees for bad debt principal from your account.

Secondary market

If you want to sell a loan on secondary market, please log in to your Finbee account, then click section “Portfolio” -> Active loans” -> Click shopping cart icon next to the loan you would like to sell on the secondary market and click “Sell”. You’ll have to choose price of the loan and term of listing duration. You can sell your loan part with premium or discount. For example, if you want to sell your loan with 5 percent discount, write “-5” in price field. This means your loan part will be sold with 5 percent discount from amount outstanding. If you want to sell your loan part with 5 percent premium, write “5” in price field. This means your loan will be sold with 5 percent premium from amount outstanding. If you want to sell your loan for the sum equal to amount outstanding, please enter “0” to price field. Then choose listing duration which can not exceed next payment date.

Listing duration can not exceed next payment date, so please try entering shorter listing duration.

You can not sell loan parts with status “Pending late grace”. This status means that there is a monthly payment pending. Please try selling this loan part after several days.

You will not be able to see your own loan on secondary market, but they are visible for other investors. You can see if you have placed loans for sale in your active loans list.

Fees

We apply 1 EUR per month investor’s account fee. No additional fees including secondary market seller fee will be applied. For new investors – 6-month free trial! Read more

Taxes related

Yes. Income tax is paid from all received interest (except 500 EUR tax exemption) whether you withdraw received interest to your bank account, keep at your Finbee account or reinvest.

According to Lithuania law, you cannot deduct your losses from interest earned. It is income that is taxed, not profits.

According to the legal requirements Finbee submits information about your earned interest to State Tax Inspection of the Republic of Lithuania (Valstybinė mokesčių inspekcija). You will find submitted information on your preliminary yearly income declaration and will have to pay an income tax of 15 percent.

Please note that from January 1st, 2018, income tax is deducted only from earned interest that exceeds 500 euros per year.

According to Income Tax Law of the Republic of Lithuania, Finbee is responsible for the collection and payment of income tax for non-residents. The income tax rate is 15 percent, and it is deducted from interest earned. The platform automatically deducts it every time when interest payment is received.

If you are a non-resident of Lithuania and you are living in a country which has valid Double Taxation Avoidance Treaty with Lithuania, you can apply for the reduced personal income tax rate. Please contact us by e-mail for further instructions how to apply the reduced personal income tax rate.

Borrowing at Finbee

Only Lithuanian residents can apply for a loan at Finbee. Person applying for a loan must:

- work in Lithuania;

- have a credit history in Lithuania;

- have a permanent residence permit;

- a personal bank account in one of Lithuanian banks.

Business loans

Only companies that are registered in Lithuania can apply for business loan.

We offer loans for:

- LCC, Ltd, small partnerships;

- Companies operating for more than one year;

- Profitable companies.

Phone: +370 (5) 219 9529 and press 2

E-mail: [email protected]

Our address: St. Ignoto st. 5, Vilnius, Lithuania.

Legal entities registered in the Republic of Lithuania that receive the loan must provide correctly filled tax declaration form FR0711 with the information of previous calendar year about received loans of 600 Euros and above. The repayments of any amount made must be reported in the form too. Finbee Business will provide the data required to fill in the form.

JSC “Finansų bitė verslui” activity is regulated by Peer-to-peer lending law. If you have any queries or complaints, please contact the Head of Finbee Business by phone +370 (5) 219 9529 and press 2 or by email [email protected]

You can learn here (https://www.lb.lt/lt/teisesaktai/del-finansu-rinkos-dalyviu-gaunamu-skundu-nagrinejimo-taisykliu-patvirtinimo), how to submit a complaint to the Bank of Lithuania.

You can learn here (https://www.ada.lt/go.php/Skundu-nagrinejimas378), how to submit a complaint to the State Data Protection Inspectorate.

Investing in business loans

Finbee Business clearly understands that investors have trust in our platform and they expect high financial return. That is why we pay a lot of attention for solvent clients’ research, customers’ verification and risk management processes.

Crowdfunding is vulnerable to the investment risks as well as other financial instruments. Before investing into unsecured loans, you must evaluate your personal and family finances as well as your business financial situation.

Your investments on Finbee Business platform are not insured in any way. In addition, there is no guarantee that a borrower will meet his financial obligations.

It is lender’s responsibility to choose a loan and to determine the risk. Finbee Business is not responsible for insolvent clients.

If you decide to withdraw the invested funds before the borrower must return it, you can do this by offering other investors to buy your loan investments. It is possible that you’ll have to sell your investments with a discount or won’t sell them at all. It depends on the demand of other investors.

It is lender’s responsibility to choose a loan and to determine the risk. Finbee is not responsible for insolvent clients.

Loans on the Finbee platform marked with a shield icon are protected by the personal guarantee of the owner or director of the business. This means that if a business is unable to meet its obligations, recovery will be directed to the business owner.

Taxes related (business loans)

Residents of Lithuania lending the money to legal entities through peer to peer lending platform must pay the income tax for interest received (class B income). That means the investor receiving any interest is fully responsible for accounting and paying the income tax. Finbee Business will provide the data for State Tax Inspection of the Republic of Lithuania (VMI). Received interest must be declared by the investor or legally responsible person in the annual tax declaration. The whole amount of the interest is taxed 15%.

Please note that from January 1st, 2018, income tax is deducted only from earned interest that exceeds 500 euros per year.

Legal entity registered in the Republic of Lithuania that lent the money for another legal entity registered in the Republic of Lithuania does not need to provide the information about the loan to the State Tax Inspection of the Republic of Lithuania.

Non-Lithuanian legal entities are not taxed if:

– The interest income is received not through permanent residence in the Republic of Lithuania and

– Non-Lithuanian legal entity is registered or organized in any other way in European Economic Area (EEA) or in a country that uses double taxation convention.

Legal entities registered in the Republic of Lithuania, investors, must provide correctly filled FR0711 form until April 15 of the upcoming year with the information about the loans over 600 Euro provided for individuals over the previous calendar year. In addition, the information about payments of any amount received over the calendar year must be provided. Finbee Business will provide the data required to fill in the declaration.

We aim to achieve excellency in credit scoring and evaluate precisely the chance of default.

We have compared business loans’ (Finbee Business, later – FB-V) to private loans’ (Finbee, later FB-P) default rates and we came to conclusion that the current business and private loans scoring is not matching and that makes it more difficult to make a decision where to invest for our investors.

We aim to match the risk understanding for business and private loans and we offer you renewed credit score system since June 23rd, 2018:

Current business loans’ D credit score loans will be reclassified to C credit score;

Current business loans’ C credit score loans will be reclassified to B credit score;

Current business loans’ B, A, A* credit score will remain the same;

Current private loans’ credit score will remain the same.

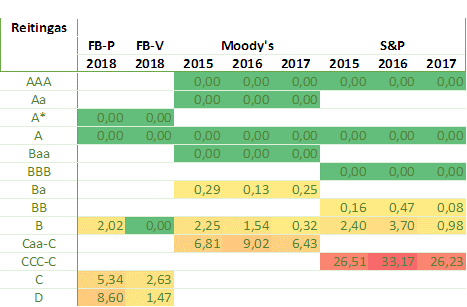

We have also compared business and private loans’ credit score to international credit rating agencies Standart and Poor‘s and Moody’s default rates (comparison below).

Default rates by ranking (%):

FB-V C credit score 2,63% does not match FB-P C credit score default (lower rate);

FB-V D credit score 1,47% does not match FB-P D credit score default (lower rate).